While many claim the Industrial Revolution is history, supplanted by the so-called “Digital Age” or “Information Age,” commercial agriculture seems to be thriving while simultaneously in both eras.

All predictions indicate rural areas need skilled workers to produce food and fiber in unprecedented amounts over the next 30 years to meet global demands. Recent Ag Equipment Intelligence research indicates many growers, faced with serious shortages of skilled labor and the need to run equipment over long duty cycles, are interested in adopting the circuits of the Digital Age to remain economically viable.

In short, the Digital Age is ushering in a new, late-to-the-party chapter of the Industrial Revolution to farming — an industry replete with innumerable variables (weather, soil types, insect and disease problems, labor shortages and ever-changing environmental regulations) that have until now defied “assembly line” solutions. Faced with having to do more with less, growers are embracing automation on the farm.

Beginning in the 1980s with aftermarket “steering assist” kits that made driving straight lines through long fields easier for tractor operators, technology became focused on what became “auto steer” in the early 2000s. At that point, digital technology had become sufficiently sophisticated to begin pursuing “guidance” of farm machinery through digital field maps and the growing use of satellite technology adapted from the military’s newly developed global positioning system (GPS). Once farm machinery could be located and tracked in the field by satellites in low-earth orbit, it was a short hop (technologically speaking) to moving “auto steer” into “guidance mode” with automated machinery capable of driving itself over predetermined routes across the field. Talk of self-driving tractors became more than coffee-shop fiction as farm equipment OEMs began developing systems and implements to leverage the emerging technology.

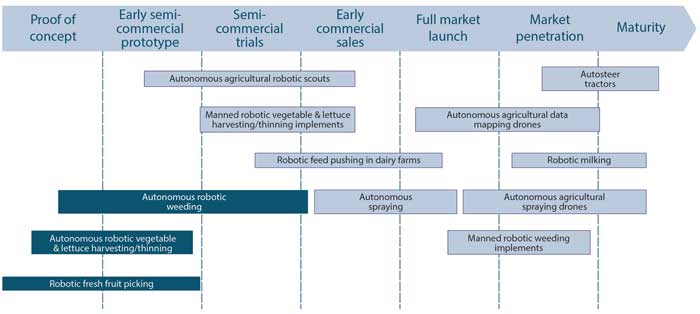

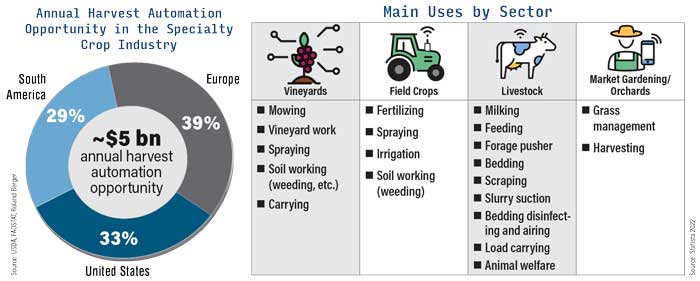

Autonomous solutions for harvesting and picking are still mostly in the development stage, whereas weed control solutions are already much more advanced and commercialized. The main reason for this is the greater addressable market potential.

Source: Western Growers Global Harvest Automation Report 2022

New digital engineering firms began appearing, offering command-and-control technology for farm equipment, and at the same time smartphone technology and cellular networks delivered “farm office computing” power to the shirt pocket of any grower who wanted it. The internet, another military engineering byproduct, began filtering into daily consumer use in the mid-1990s and by 2009 data information surpassed voice communication on internet-based cellular networks. Technologically, the tipping point for automated farm equipment had occurred.

Autonomous Farming: Adoption Across Many Fronts

It usually doesn’t take long in conversations about automated farm equipment until someone mentions: “Farmers will just go out in the morning, start their tractor, turn it loose in the field and go back to the office for a second cup of coffee.”

While the technology is certainly there to make this possible, the truth of the evolution of autonomous farm equipment over the past 20 years is much more complicated. The infinite variability of agriculture itself, along with the fact every farming operation is unique, means automation will emerge in various ways and will not likely come neatly packaged in an automated farm system. True, John Deere unveiled a fully autonomous 8R tractor and chisel plow unit for full autonomous tillage in early 2022, but many growers don’t use chisel plows. Still the technology exists, and Deere and other OEMs are busy finding ways to adapt equipment to the many methods and chores of planting, fertilizing, spraying and harvesting crops.

Patricia Boothe, senior vice president of Trimble Autonomy, explains it this way:

“Farmers have different needs at different times, and this is how many will experience autonomy — as a progression.”

Boothe says that progression will provide value to growers by reducing input costs, increasing productivity, improving safety or solving labor shortages.

“Can we use less fertilizer or pesticide? Can we optimize the seed variety we’re planting? Can we reduce our emissions or fuel usage?

“Bottom line is, you don’t need a cab with air-conditioning, a multi-position cushion seat, a refrigerator, a sloping hood, multi-functional joystick or extra noise and vibration abatement…” – Scott Shearer, Ohio State Univ.

“When we get into the details of autonomy, the goal is to perform each of these operations better than we did before,” she explains, reflecting the goals of her company to deliver improved value to the farmer.

“Farmers themselves will be the ones to decide how far and fast they want to advance along their own autonomy journey,” she says.

Within automotive and off-road equipment engineering and industry circles, the following 5 levels of autonomy are generally accepted:

- Level 1 – Operator performs most tasks: Artificial Intelligence (AI) or “machine learning” provides basic guidance assistance that optimizes human decision making.

- Level 2 – Operator is hands-on with minimal guidance assistance: Vehicle can take over basic functions such as speed, steering and monitoring machine components, leaving the operator in a “hands off/eyes on” mode.

- Level 3 – Operator is hands and eyes off, but mind on: Machine operates totally independently with only human observation.

- Level 4 – Operator’s hands, eyes and mind are focused on creating value: Operator is able to automate and end-to-end workflow.

- Level 5 – Machine operates with full autonomy: Vehicle will replace traditional human operator tasks, going anywhere and doing anything an experienced human operator can currently achieve.

Boothe, who notes Trimble has been involved in various levels of autonomous design for nearly 20 years and has autonomous equipment installed on more than half a million farm machines worldwide, says her company has its own take on the 5 levels of autonomy.

AgXeed’s AgBot 2.055W4 manages a wide range of tasks including light tillage, seeding, weeding, mowing, swathing and tedding. Photo Courtesy of AgXeed

“On our team, we now talk about moving from operator assistance to task automation to supervised autonomy, full workflow automation and, finally, network optimization.

“With those higher levels of automation, full workflow automation and network optimization themes, we’re talking about affecting the entire farming operation, regardless of its size,” she says. “At that stage, autonomy isn’t only about controlling the machine, it’s about maximizing and optimizing use of information that allows farmers to make better management decisions.”

Boothe says autonomy is already on the farm and has been progressing there for many years: Think variable-rate fertilizer and irrigation water application, sprayer boom-height control, AI-driven on-the-go combine setting adjustments at harvest, and “See and Spray” smart sprayers that identify weeds and target them with controls at field speeds.

She’s convinced the progression will continue as farmers turn to a variety of automated systems to solve various needs as they become economically important to their individual operations.

Acceptance & Emergence

Overall, most industry watchers say the state of autonomous technology in agriculture — as of late 2022 — hovers somewhere within the broad categories of Levels 3 and 4, with new applications and refinements continually being unveiled.

Those within the industry agree and see a relatively quick adoption of autonomous technology on farms over the next 5 years — especially for applications that eliminate repetitive tasks and reduce skilled-labor costs. They also say grower input and cooperation is vital to developing systems that improve farm operations and workflow.

Commercially available since February 2022, Carbon Robotics’ LaserWeeder targets and eliminates weeds using 30 high power CO2 lasers that reach across roughly 3 rows of crops or 20 feet. Photo Courtesy of Carbon Robotic

John Preheim, vice president of product development for Raven Industries, says the recent Case IH Trident 5550 applicator with Raven technology is a good example of today’s Level 4 farm machinery. The new model brings driverless technology to material application after an operator first defines the mission, maps the field boundaries and creates a path plan.

“A year ago, we unveiled OmniDrive, an autonomous grain cart, as part of an emerging portfolio of autonomous chore-specific machines, another example of Level 4 autonomy,” he explains.

Both of these systems were developed with actual customers who are seeking to improve their workflow with autonomy, he says.

“Now that we are part of CNHI we have access to many more growers and we’ll be engaging with them, leveraging the tools that both we and Case IH and New Holland have at our disposal,” he explains.

“As it is, the Trident is a great example of customers accepting — and helping develop — autonomous technology. As a company we have tools for dispatching machines, creating work orders and sharing information between multiple machines, and we now get to draw upon all of that while working with customers to help them determine the best way to leverage the technology for their individual needs.

“No one’s done this before, and the only way to learn what’s needed is to get with customers and that’s how we are doing it today.”

At JCA Technologies, a recent acquisition of AGCO and longtime Canadian farm electronics developer, Darcy Cook agrees grower experience in the field is key to initial and further acceptance of autonomous technology.

Cook, vice president and general manager of JCA, says the progression of acceptance starts with simpler, repetitive jobs, not the systems with the most electronics and “smarts” in them.

“If you look at planting and harvesting, those are the most high-value operations on the farm because they involve the most risk of economic consequences if they aren’t done correctly,” he explains. “Because of that, I think they will come later — beyond 5 years — on the scale of grower acceptance.

“Of course, during that time there will be early versions and proof of concept models being developed, but I see widespread grower acceptance coming in applications like automated grain carts for harvesting. That’s an important job that needs to be done and typically is accomplished with lower skilled operators,” Cook explains.

“Also, because of chemical exposure risks, I think growers will gravitate toward automated sprayers,” he says. “There also are many odd jobs and specialty equipment within agriculture and I think those are the first opportunity for really putting autonomy to work because it will allow farmers to take out the lowest-skilled operators, leaving resources to support higher-skilled personnel to add value to their operation.”

Finlay Wood, general manager of off-road autonomy at Trimble Inc., an industry leader in agriculture automation, connectivity and data analytics, says agriculture is likely to accept full autonomy technology quicker than many other industries.

“When Trimble started its auto guidance systems more than 20 years ago, that really set up agriculture for acceptance of autonomous technology because growers began to see very quickly how such engineering can help them become more efficient,” he explains.

Nexus Robotics’ AI-guided weed picking robot navigates autonomously using the RTK GPS system and control remotely. The company says the cost is about $50,000 per growing season. Photo Courtesy of Nexus Robotics

“We’re not talking about replacing tractors with a robot that will do everything for you. That’s a pipe dream, and it’s certainly not something we’ll see widespread in the next 5 years.

“We’re looking at applications that will help farmers do their jobs more easily and cost effectively,” he says. “Over the next 5 years were going to continue to see the progression of automating repetitive tasks that farm workers are executing today.”

Wood says for planting and harvesting, growers still want to be present because of the high value of both tasks and are very hesitant to buy into the prospect of full, Level 4 or 5 automation of either chore.

“But, if they could drive into the field and the machine already knows the optimal way to traverse the field given the type of implement and operation at hand, and it can control its own steering and speed, plus make adjustments to the implement, then they are there to supervise the tasks that set them up for the year’s pay day.

Learn more about the impact autonomous farm machinery will have on North American dealers, manufacturers and suppliers in Ag Equipment Intelligence’s report, “Autonomous Farm Equipment: U.S. Farm Adoption & Outlook.”

“At the same time, they can be doing office chores from the cab like ensuring their fertilizer order is in place or answering text, radio and telephone calls. Many will find time to be supervising workers or other semi-autonomous or autonomous vehicles such as grain carts.

“I think our grower customers will see the value in these things, and that will drive acceptance forward faster than many might predict.”

Scott Shearer leads efforts at Ohio State University’s Food, Agricultural and Biological Engineering department to explore how technology is reshaping agriculture. He sees a 5% market penetration of fully autonomous (or retrofitted) tractors within 5 years across North America as farmers seek to address the labor shortage and cut labor costs.

“When you see 10% of the market with autonomous technology installed, the market — and widespread industry acceptance — is all but assured,” he explains. “This is much like when auto steer and yield monitors first appeared. Once growers saw the value, they let equipment manufacturers know the demand existed and wasn’t going to fade away.”

Meanwhile, Israeli startup BlueWhite (formerly Blue White Robotics) sees very rapid adoption of robotics in its core business along the U.S. West Coast in high-value crops from vineyards and orchards.

BlueWhite offers a subscription-based turn-key autonomy program based on a common digital architecture and retrofit components for existing farm equipment fleets.

“I think over the next 5 years you’ll find the use of autonomous technology to be somewhere around 50% of the farm vehicles in our market area, simply because of the operating costs and lack of available of labor,” says Ben Alfi, BlueWhite CEO and founder. “Given low profit margins in much of North American agriculture, growers are looking for solutions like ours to reduce operating costs”.

Alfi says among the several dozen growers BlueWhite is serving from California to Washington, economic calculations on some of their farms show 35-75% reductions in overall operating costs through the adoption of autonomous technology.

The Horsch Robo is a self-propelled 24-row planter with a 300 horsepower diesel engine and is equipped with a Trimble navigation system. Photo Courtesy of HORSCH Maschinen GmbH

BlueWhite’s business model is centered on high-value crops, but Alfi says even broad-acre farms of the Great Plains will be home to increasing use of autonomy by 2027.

“There, we envision a mix of robotic equipment running alongside highly automated machines under the control of human operators to make optimum use of time and resources through a 24/7 runtime,” he explains.

Shearer says the labor shortage — exacerbated by the pandemic — is a No. 1 issue in agriculture and products like the Trident 5550 applicator with Raven technology is an example of industry’s response.

“A co-op manager I visited with recently indicated his firm was short 10 floater drivers so it bought a DOT (now part of Raven’s Omni portfolio) to work in tandem with a human-driven floater to multiply efforts of the staff,” he explains. “What they found was the autonomous DOT was doing a better job of fertilizing than the floater truck and driver. Now, the co-op is looking at more automation as a solution to their labor shortage.

“As co-ops and large farming operations begin successfully using machines like the Trident, growers will be exposed to Level 4 autonomy in action and likely will become more comfortable as other applications of Level 4 capability are introduced,” he explains.

Shearer also sees retrofit autonomy systems becoming more popular — a market AGCO has fully embraced with its acquisition of JCA Technologies in March 2020, and an open acknowledgement of its intent to supply aftermarket autonomy needs.

Seth Crawford, AGCO’s senior vice president and general manager of Precision Ag and Digital, says the JCA acquisition allows AGCO to provide retrofit autonomous technology on its own older Massey and Fendt tractors but also other brands such as Case IH, New Holland or John Deere.

“Retrofitting is a key part of how we operate our Precision Planting brand and not many others do that,” he explains. “We know farmers’ disposable income is limited and how they can invest is limited.”

He says AGCO’s approach is to show those with limited funds how to make investments from year to year in increasing layers of autonomy to maximize their output without buying a new machine.

“We try to create solutions in a very scalable manner,” he explains. “If they wish to retrofit a planter, they don’t need to retrofit the entire machine. They upgrade a section at a time to enhance functionality and performance without going fully to robot remote control.

GUSS is an autonomous spray vehicle designed for use in orchards and vineyards and currently available through select John Deere dealers. Multiple units can be remotely supervised by a single operator. Photo Courtesy of GUSS AG

“The same with sprayers. If a grower can improve performance of a sprayer section-by-section that can gain agronomic advantages over time at a fraction of the cost of a new fully outfitted system.”

Changing Business Models

While emerging from infancy to at least adolescence, on-farm autonomy is already disrupting “business as usual” in agriculture. From the shape and size of farm equipment to various business models to supply growers with automation, the entire industry is in flux.

Shearer says farming is an expensive business and that has largely driven equipment design to allow growers to do more with less by providing them with higher horsepower tractors, larger implements and harvesters with increasing field capacity. That could be changing, however.

“Over the past 60 years, we’ve seen higher-horsepower tractor weights increase by 800-900 pounds per year,” he explains.

“We’ve seen the increasing tire sizes and the introduction of tracks to reduce compaction as these heavier machines gain popularity, but over the past 30 years farm parcel size has remained relatively constant,” he says.

“My friend John Phipps at U.S. Farm Reports estimates modern tractors spend 50% of their time on roads and highways moving from field to field,” Shearer explains. “High horsepower tractors are used about 300-500 hours a year, and if Phipps is correct about the highway use, that means these very expensive tractors are used only about 150-200 hours per year actually working on the farm. These figures reveal the ‘productivity cost’ of ownership has climbed significantly.”

Shearer says removing the human operator from a tractor design can make substantial money-saving changes to equipment design.

“Bottom line is, you don’t need a cab with air-conditioning, a multi-position cushion seat, a refrigerator, a sloping hood, multi-function joystick or extra noise and vibration abatement,” Shearer explains. “That removes a lot of weight and expense from a tractor and reduces the amount of horsepower needed to accommodate that weight and to power creature comforts.”

As time passes, Shearer says automation likely will see a rise in popularity of smaller, lighter, less-powerful equipment along with matching implements, something he says is being demonstrated by AGCO’s commitment to retrofit access to autonomy and Sabanto, a 4-year-old startup technology company founded by Craig Rupp.

“Craig is offering a retrofitted Kubota M5 without a cab as an automated tractor for under $100,000 and a $2,000-$2,500 annual subscription to digital technology to make it work,” Shearer explains. “If that tractor runs 24/7 you don’t need a 400-500 horsepower tractor, and the cost saving is substantial.”

While Rupp is developing retrofit kits and services at Sabanto, he also has skin in the game operating automated tractors — at nearly Level 5 automation capability.

“Over the past 2 seasons we’ve had 2 three-tractor teams — 100 horsepower-range tractors — operating in Missouri and Nebraska. In each case, one machine was doing field cultivation while the other two followed with planters,” he explains. The automated field operations were part of Sabanto’s “Farming as a Service” business, doing field work on a custom basis for growers.

The Naio Orio is designed for large-scale row crops and beds of vegetables and arable crops. It’s available as both a Robot As A Service or for purchase in both the U.S. and Europe. Photo Courtesy of Naïo Technologies

“We have instrumented implements and totally autonomous tractors, and we have deployed multiple systems that have run 48-hours non-stop in 480-acre fields,” Rupp explains. “I can tell you from 9 p.m. until about 6 a.m. no one was watching these machines.

“People ask me when we’ll see Level 5 automation in agriculture,” he says. “I tell them, we’re doing it now.”

As far as tractor size, Rupp says he easily favors the $0.05 per horsepower per hour operating cost of smaller tractors vs. the $0.25 figure for the higher-horsepower units. Also, he says if he needs to cover more acres per hour with his custom service, he can deploy another smaller rig to the field using the “swarm” concept. He also notes, with several units operating, if one fails, the entire operation is not idled as if it would be with a single large tractor failure.

“Also, I wanted something I could pull with a ¾-ton pickup truck without a commercial driver license,” he explains. “Farmers complain about finding CDL drivers, and I didn’t want to inherit their problem — I want to solve their problems.”

While his own business model involves smaller traditional tractors, Rupp says he’s convinced most tractors in the future will largely continue to have seats, steering wheels and room for human operation — despite what he calls today’s “Zamboni Look” of prototype autonomous tractors from major OEMs.

“Everyone has cruise control in their car or pickup truck, but you don’t use cruise control to back out of the garage,” he chuckles. “There are times you just want to move the tractor from point A to point B. For instance, I just used one of my autonomy-equipped 4WD tractors to pull my pickup out of the mud — not something you use field maps and RTK to accomplish.”

Overall, Rupp views automation as a method to better capture time.

“James Watt, the famous Scottish scientist postulated ‘horsepower equals work divided by time,’” he explains. “Horsepower is inversely proportional to time. If you look at a 200 horsepower tractor running 24 hours, it can do the same amount of work as a 400 horsepower tractor running 12 hours.” As he points out, that 200 horsepower tractor could have been running autonomously through the night instead of having to rely on a human operator at the controls.

“The brutal reality of the future is you’re going to see a lot of farmers focused on continually reducing their capital and operating expenses, and I think autonomy is going to lead us in that direction.”

Sabanto is also moving toward becoming a retrofit supplier of off-the-shelf autonomous hardware driven by a common digital architecture (Trimble Ventures recently invested in Rupp’s firm for an undisclosed amount.)

“The large OEMs for the most part are focused on really expensive, high-margin, 500-plus horsepower tractors, and I think smaller farmers are getting left in the dust,” Rupp explains.

“For instance, a new John Deere X9 combine with a corn and bean head was listed on social media recently with a quote for $1.3 million. Now, who is going to buy that used if you’re farming 800-1,000 acres? There’s no way you could buy even a $500,000 combine.

“With several units operating, if one fails, the entire operation is not idled as if it would be with a single large tractor failure…” – Craig Rupp, Sabanto

“Now a company like Sabanto may be taking it to the limit but I have a 60 horsepower cabless, open ROPs Kubota tractor that planted 750 acres in one growing season and it was in no way taxed to do that. It wasn’t running 24/7, but there were some instances it ran 48 hours non-stop.

Rupp says when Sabanto began developing its systems, interviews with the largest farmers showed average field size was roughly 160 acres.

“With our equipment, we envision dropping off the equipment at 7 a.m. and going back 24 hours later to pick it up and move it to another field. This machine must do 160 acres in a 24-hour period, which turns out to be about 6.5 acres per hour – which we can do with a 10-foot planter going 6.5 mph,” he explains. “So, it’s doable with smaller equipment.”

Rupp gives one of his potential customers as an example.

“This man wants to get rid of his entire line of 20-plus year old equipment and instead of buying used big equipment to replace it, he’s buying one of my smaller Kubota M5 111 tractors with automation and equipping it with a high-quality 10-foot tillage rig and a top-notch 10-foot planter.”

Shearer says moving to smaller equipment also offers cost-saving simplicity and maintenance cost reductions in pulled implements.

The engineer notes a 24-row planter covers 60 feet and requires substantial engineering to enable that machine to fold to transport widths.

“There is a lot of development cost in just designing a folding implement that doesn’t address what that implement has to do in the field,” he explains. “Also, a lot of maintenance issues and quality problems can be traced to the folding mechanism.”

Rupp agrees, saying Sabanto has yet to use any folding equipment, and may never because “these smaller tractors seem to fit the bill for a lot of farmers.”

Another example of changing business models springing up in the equipment business is BlueWhite’s retrofit system which matches a common digital architecture with phased-in hardware upgrades enabling growers to incrementally move into autonomous operations with continual access to all of the company’s latest features for one multi-year contract price.

CEO Alfi says the company believes in:

- Maximizing existing assets

- Connectivity throughout a farm’s autonomous equipment

- No one vehicle on the farm suits all jobs

“We transform any type of farm vehicle/machine, regardless of brand, to do the job needed and connect it to other machines in the fleet operating with the same digital system,” he explains. “Our niche is based on not requiring the grower to buy a completely new autonomous-from-the-factory machine to realize the efficiencies of autonomy.”

Alfi says over the past 10 years agriculture has busied itself tackling yields instead of developing farming methods to reduce costs.

“When you tackle yield to the point you have huge revenues and very low margins, the obvious question is ‘Who is paying until yields are proven?’” he says.

“That’s what we’re doing now with our ROI calculator,” he explains. “Using this tool a grower can input the crop, how many acres are involved, how many tractors are running, what is their average cost of operation, labor costs, costs of inputs, how many times you’re doing certain jobs — mowing, spraying, etc., — all that is considered.

“We can then show the grower an alternative operating cost estimate of what our system can offer over existing management practices, and we’ve seen 35-75% reductions,” he explains. “The idea is the customer can see what an autonomous operation would cost to operate vs. a manned operation on the same farm.”

Alfi says BlueWhite has a 3-year, 3-phase program in which it will retrofit 4 vehicles to autonomous operation, then another 4 the following year, and finally “full fleet” (about 70% of the farms’ existing off-road motor pool reflecting reduced need for total tractor numbers).

“Customers pay for this service — in 3- and 5-year contracts — on a quarterly basis and can opt out if for some reason they don’t like what they’re receiving,” Alfi says. “However, they know what their return on investment will be because of the ROI calculations we use, and we’re confident they will see lower production costs than other alternatives.

“Customers have access to all of our digital tools at all times, including tech support and any new features we might stack into our product.”

BlueWhite is launching its service in the U.S. on the West Coast with eyes on the East Coast and upper Northeast within the next 2 years. Alfi also says the company will be offering its programs in Europe within the next 5 years.

Challenges to Autonomy Adoption

AEI’s research and industry experts cite two major impediments challenging rapid widespread adoption of autonomous technology, both of which likely will tend to become less important in time. They are:

- Growers seem to distrust safety and reliability of machinery working without direct human supervision.

- Large areas of North America lack reliable cellular service and internet connectivity.

“The safety and reliability concerns are absolutely valid concerns,” says Jennifer Edney, CEO of Edney Distributing. “Innovators are going to have to prove the equipment safely does what they say it will do, and they are going to have to be able to support that equipment in the field.”

Raven’s OmniDrive harvest application gives the combine operator control to autonomously call a driverless grain cart tractor directly to the combine to off load without a second operator. Photo Courtesy of Raven Industries, Inc.

Edney’s long-time Minnesota farm equipment distributorship recently agreed to handle Naio’s robotic products and has been demonstrating the “Oz” platform at venues such as Wisconsin Farm Technology Days, the Minnesota State Fair and the Pioneer Equipment Dealers Assn. The Naio Oz is an electric robotic tool platform capable of operating a variety of implements such as the weeder attachment Edney has been demonstrating.

“We’re just in the process of introducing this technology,” Edney explains. “Our job as a wholesale distributor is to always be on the lookout for emerging technology that solves problems for our growers, and we’re convinced robotics is going to make a big impact in solving the labor shortage problems in agriculture.” Edney, a fourth-generation principal in the upper-Midwest distributorship, says autonomous technology can help reduce operating costs, address compaction issues through smaller, lighter-weight machinery, and, in the case of the Oz, can reduce chemical input costs through unsupervised mechanical weeding.

“Before there’s wide acceptance of this technology, however, we must get this first iteration of robots in front of the grower public, and that will come with cooperative efforts involving companies like ours, the universities and government agencies,” she says. “The Grand Farm Initiative in North Dakota is another good example of an organization dedicated to such collaboration, where researchers are developing the ‘future farm’ with leading-edge technological systems involving businesses and other organizations.

“Innovators I visit with at trade shows and technology expositions are committed to providing 24/7 access to high levels of online support for growers and dealers working with autonomous technology machines, so as this technology matures and stakeholders become more comfortable with it, I think the ‘service concerns’ will certainly be addressed.”

Raven’s Preheim agrees, saying the “grower distrust” issue can only be solved as farmers gain experience with autonomous technology in the field.

“Over time, all that will matter is customer comfort that the products we’re selling will do the job they need in a safe and reliable manner,” he explains. “We’ll get there by connecting them with autonomous technology for tasks important to them in the progression of technology and, as their experience with autonomy grows, products for more complex operations won’t seem quite as daunting.”

While safety systems are engineered into each vendor’s autonomous platforms, Preheim says that to provide safety and reliability on machines without operators, additional expansion of digital technology in rural areas is necessary to drive the adoption of autonomy.

“It boggles my mind that RTK isn’t there for everyone who is farming,” Preheim says. “There is collectively so much value and precision in sub-inch accuracy that everyone should be running it.”

“Wireless connectivity currently is a substantial problem,” says OSU’s Shearer. “For instance, the new OmniDrive autonomous grain cart has 3 radio links and even in areas with cellular service many farm fields have intermittent or no service whatsoever.

“If 5G is required, in Ohio today that means 35 miles either side of I-71, which leaves a lot of Ohio unserved,” he explains. “I’m confident in 5 years the situation will be much better than today, but I still drop cell phone calls on a drive across the state.”

Shearer says digital interconnectivity is so important it’s beginning to affect farm lease negotiations.

“I visited with one grower recently who said reliable wireless service is worth an extra $10 per acre in rental fees, and another said he’d consider up to $30 an acre more for rented ground that offered strong cell signals,” he explains.

Shearer says private cellular companies using newly released frequencies that at one time were the backbone of the Citizens Band radio spectrum will likely begin to fill the digital gaps in remote rural areas.

“I take nothing away from Star Link [referring to Elon Musk’s growing satellite-based ‘global broadband’ company], but private cellular networks will probably lead the way serving areas without 5G over the next several years,” he adds.

As one who sees great potential in the automation of field work in agriculture, Edney says she sees rapid adoption of the technology over the next 5-7 years as growers become accustomed to working with robotics alongside their other operations, and as autonomous systems become more affordable as the cost of robotic components fall.

“Right now, we’re in the education phase of this technological revolution,” Edney explains. “I like to remember my grandfather, Milton Edney, was contacted in the 1970s by Moridge Manufacturing which had just acquired a brand-new lawn mower — a zero-turn design. They gave us two and challenged us to sell them.

“My grandfather and his sales associates began introducing them to the public and people were laughingly saying: ‘Well, it’s not a mower.’

“They kept doing demonstrations and educating on-lookers. Soon people began to realize the value of ZTR mower technology and it rapidly became commonplace throughout the industry,” she recalls. “Changes of practice, changes of ideas, shifts in technology take some time to be proven in the field to allow people to wrap their minds around the possibilities.

The SwarmBot robot is an autonomous platform suitable for multiple applications. SwarmFarm partners with third party attachment manufacturers for deep software and functional integration onto the robots. Photo Courtesy of SwarmFarm Robotics

“Now, industry reps are saying the more people use and see the robots, the more applications they see are possible,” she says. “We think growers are such industrious people they will take this technology and make it their own.”

Handicapping the Move to Farm Autonomy:

Autonomous technology is currently hard at work on many farms across North America although the robotic farming scenes in the opening minutes of the original Star Wars movie may still be relegated to a time far, far away. However, interviews with independent and major players in the move toward automating increasing chunks of farm labor indicate autonomy on the farm will likely occur as a progression of adoption based on immediate and specific individual farm needs to reduce overall operating costs.

From those interviews we’ve assembled the following conservative timeline representing current and projected future use of autonomous technology in food and fiber production.

- Level 1 — Operator performs most tasks: Artificial Intelligence (AI) or “machine learning” provides basic guidance assistance that optimizes human decision making. Currently on-board as auto-steer. Will continue to be backbone of conventional farm equipment autonomous systems over next 5 years.

- Level 2 — Operator is hands-on with minimal guidance assistance: Vehicle can take over basic functions such as speed, steering and monitoring machine components, leaving the operator in a “hands off/eyes on” mode. Currently on-board with harvester systems maintaining on-the-go machine adjustment according to crop and field conditions and sprayers which follow field maps and on-board sensors for variable rate application. Newly minted “See and Spray” sprayers will continue to be honed in their accuracy as artificial intelligence libraries develop to improve plant disease and pest control — with minimal input from on-board operator. Level 2 will certainly continue to assume additional duties in “developing” implement systems over next 5 years, particularly as it relates to maintaining contact with other vehicles — both driven and driverless — to coordinate increasing amounts of overall operational duties at harvest, planting and during application work.

- Level 3 — Operator is hands and eyes off — and likely in another vehicle in the field — but mind on: Machine operates totally independently with only human observation. Currently in operation at harvest as autonomous grain carts keep combines running as they move newly harvested grain from an on-the-go combine to awaiting transport trucks. Over the next 5-7, years similar technology will be used to supply planters and sprayers with fuel and product during field operations, particularly as automated tractors and implements are likely to become smaller and lighter as systems adopt longer run-times throughout nighttime hours.

- Level 4 – Operator’s hands, eyes and mind are focused on creating value: Operator – likely in another vehicle or a nearby farm office — is able to automate and oversee end-to-end workflow. Currently in farm fields with automated planting, such as Sabanto Ag, Case IH Trident applicator and Trimble’s OmniDrive tools. Level 4 and Level 5 begin to blur at this point as today’s Level 4 machines are quite likely “early iterations” of machinery that will become totally autonomous (Level 5) over the next 7-10 years. Look for development of Level 4 autonomous feeder trucks/robots in large CAFOs (confined animal feeding operations) within the next 5 years, along with continual improvement and acceptance of robotic application of fertility and crop protection products.

- Level 5 — Machine operates with full autonomy: Vehicle will replace traditional human operator tasks, going anywhere and doing anything an experienced human operator can currently achieve. Currently, this level of autonomy is in operation in rural lifestyle settings and municipal parks with fully-electric small-scale mowers capable of maintaining large yards and green-belts with no human intervention through long duty-cycles (much like robot vacuums at work in homes and apartments every day). Given the remote nature of agriculture in North America, however, this level of autonomy will require much development to amass sufficient machine learning to apply best-management-decisions to a machine’s own operation, plus the “go anywhere” function will require integrating this equipment into safe transport on public roadways and various gates and lanes found on most farms. Similarly, machines used as Level 5 equipment will need on-board logistical software to summon “fuel” and farm input products as it goes about its unsupervised business. Look for Level 5 applications such as these to be emerging by 2032 as dependable rural broadband internet access begins to be commonplace in areas other than high-value crop production areas in California.

Sticker Shock or ROI-driven Acceptance

Many respondents to AEI’s surveys, both growers and dealers, seemed to recoil at their perception of the “high cost” of adopting automated equipment and providing services to machines of increasing autonomous capability. And the majors and specialty equipment manufacturers actively developing automated farm equipment and systems, agree the technology isn’t “cheap” — particularly given recent supply-line-related shortages of microchips.

One major OEM spokesperson was recently quoted that in 2022 his company was paying $1,400 for microchips that cost “$10-20 each” in 2018. He explained his company was paying the higher cost for the chips “just to get the products into customer hands.”

Grower Cost Concerns

Regardless of the cost of the hardware to build autonomous systems, the engineering effort is underway to solve farmer problems, particularly the shortage of qualified farm labor in industrialized nations and ever-increasing costs of operation. To sell those products, engineers and product development specialists emphasize their products will need to solve an economic problem and be able to do it with a positive ROI to their owners. “We’re not developing these systems just so a farmer can watch a machine work on its own in the field. Also, we’re not putting people out of work with automation,” they say. “We’re actually helping ensure our farmers can still produce crops with an ever-shrinking workforce.”

Yes, the equipment will be expensive, but it must be priced at a level by which its usefulness can pay for itself in a reasonable amount of time. Several grower respondents to the survey indicated they would likely be in the market for Level 4-5 equipment if it penciled out over a 10-year period. Another industry watcher shared a co-op farm service business in the Eastern Corn Belt was negotiating the purchase of a fleet of Level-4 fertilizer applicators to address the shortage of qualified floater drivers in the area.

Dealer Cost Concerns

The number one worry echoed by most dealers registering their concern over automated equipment in the showroom and service department was finding and keeping qualified service personnel to support the new systems.

As agriculture moves to automated equipment, there likely will be growing pains as equipment support demands increasing numbers of well-trained (and equipped) service technicians in areas already strapped to maintain a cadre of conventional mechanics. Major OEMs say they will have training programs for their dealers, and smaller automated ag service providers, such as BlueWhite in California, are offering multi-year service contracts with a well-placed service fleet to keep customers of their retrofit autonomous systems in the field.

Autonomous farm equipment, regardless of its level of sophistication, is disruptive technology compared with ag equipment sales and service of 1990. But with proven reductions in operating costs (Blue White shows 35%-75% reductions for their customer growers) and the ability to do more with fewer farm employees, the systems are here to stay.

The market will be the final arbiter of the cost of automated farm equipment and solutions to related challenges of maintaining such sophisticated equipment in large, remote rural areas.

Related Content:

Weighing The Viability of an Autonomous Future

Dealer Perspective: Concerns About & Customer Interest in Autonomous Farm Machinery

Sabanto Works to Make Autonomy Affordable, Reliable & Scalable

Fresno Equipment Prepares for the Future with Entry into Autonomy Arena

Post a comment

Report Abusive Comment