After what looked like some progress at the end of last year, dealers in the February Dealer Sentiments & Business Conditions Update survey reported that both new and used farm equipment inventories sitting on their lots remains “too high.”

One dealer remarked, “Trying to lower new and used inventory is like swinging a double-edged blade.”

New Equipment Inventory

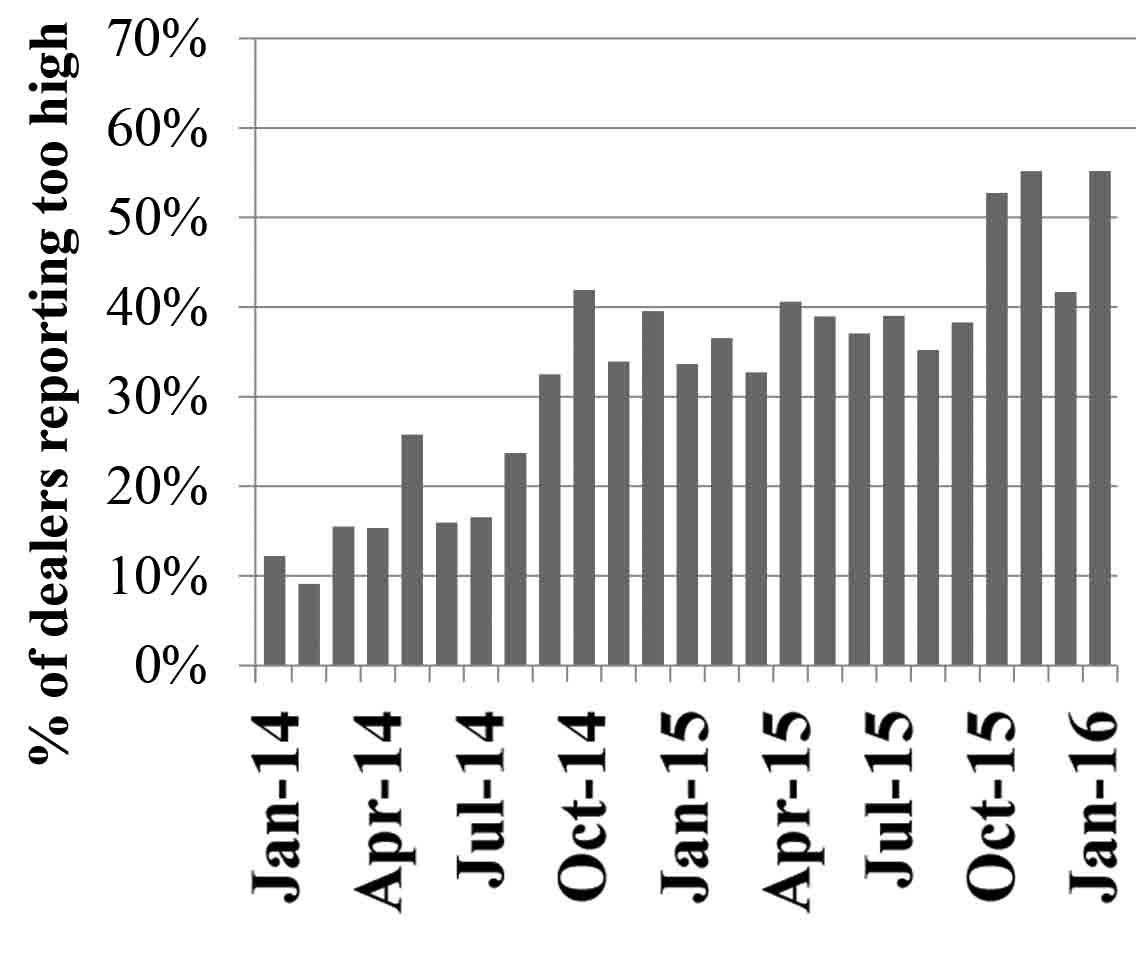

Overall, a net 60% of dealers reported new equipment inventories are too high (62% too high, 36% about right, 2% too low) vs. 42% (44% too high, 54% about right, 2% too low) in the previous month. This compares to an average of 50% in the fourth quarter who said their new equipment inventories were “too high.” This was the 17th consecutive month where new inventory levels of new equipment were reported as “too high” by more than a net 30% of dealers. It was also the worst reading in survey history, which dates back to May 2011.

New Ag Equipment Inventories

Dealer commentary on the new inventory included:

- “There’s been no incentive for farmers to buy equipment yet. They know the market is going lower and are going to wait to get the best bargains that are out there.”

- “Bankers continue to pressure farmers on putting off equipment purchases.”

- “Traffic was very slow in the month, even seed customers are in no hurry to make a decision on what they want to plant yet.”

- “OEM reps have been very aggressive in getting me to order product even though my lot is full.”

- “I noticed an increase in large OEM inventory at a lot of dealerships in the past month. The manufacturers are overloading dealerships with equipment.”

- “Customers are making drastic budget cuts to control input costs, and new equipment purchases are the first cut.”

Used Equipment Inventory

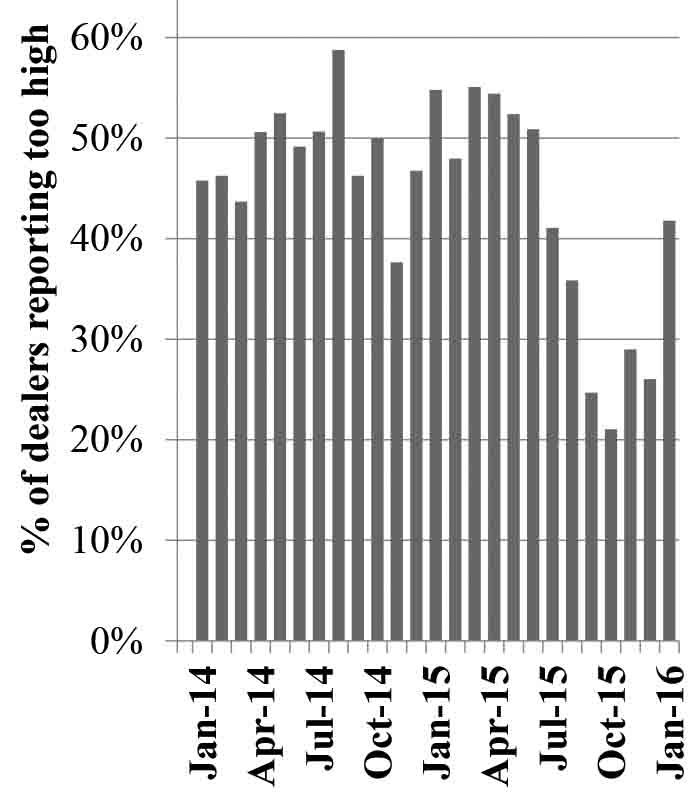

On the used equipment front, a net 40% of dealers reported used equipment inventory as “too high” (47% too high, 46% about right, 7% too low) vs. 38% in December (47% too high, 44% about right, 9% too low).

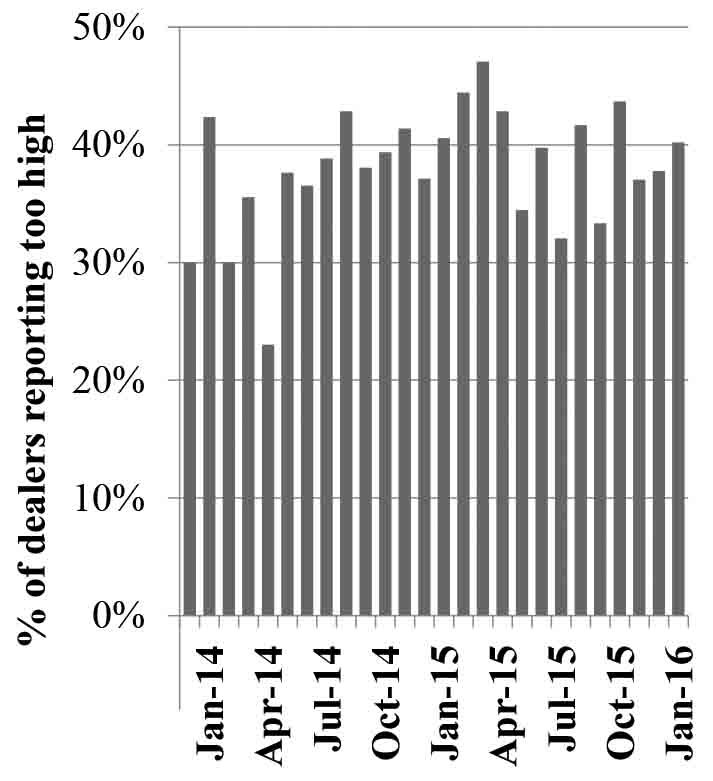

Used combine inventory remains “too high” with a net 42% of dealers reporting inventories above where they would like them, a significant decline from the net 26% reporting high inventory last month. This marks a stark change from the prior trend of combine inventory outperforming general used inventory levels.

Dealer commentary on used included:

- “Deere removed interest free financing on used high horsepower tractors.”

- “We continue to be too heavy in large equipment particularly used combines over $125k, planters and harvesters. We’re beginning to see an increase in hay tools inventory in our area, as well.”

- “The weak Canadian dollar has allowed us to ship lots of equipment into the United States.”

Used Combine Inventories

Used Ag Equipment Inventories

Equipment Pricing

On new equipment dealers report several OEMs pushed through small price increases in the fourth quarter (~0.5-1.0%), with respondents reporting pricing in January improving slightly at 0.2% year-over-year. The effect of the strong U.S. dollar on Canadian exchange rate has also, played a part in pricing inflation within North America.

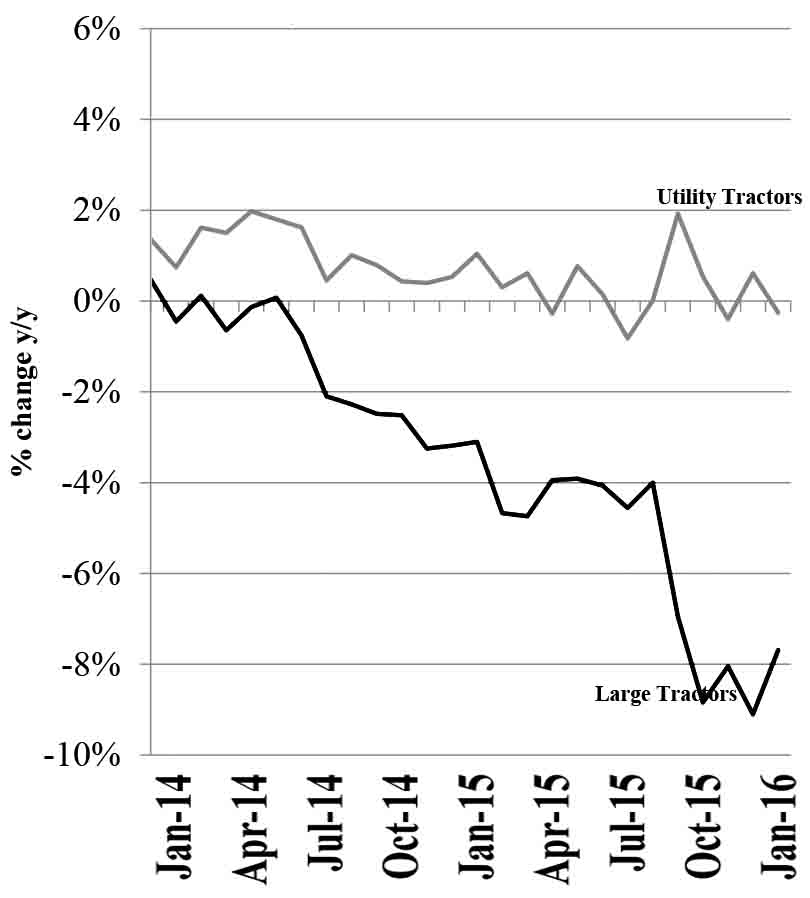

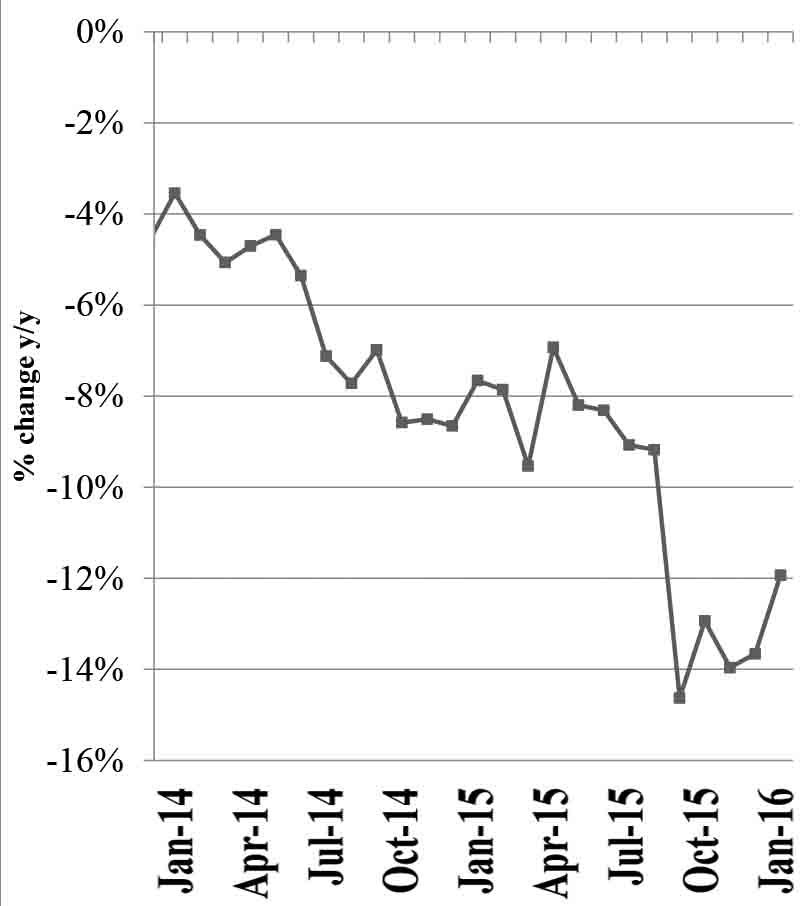

For used machines, January saw slightly negative pricing for small tractors, in line with the previous months. Large tractors were reported down 8% year-over-year on average, slightly better than the 9% reported in December and in the fourth quarter. Used combine pricing was down 12% year-over-year, a slight improvement over the 14% decline reported in fourth quarter.

Used Tractor Pricing Trends

Used Combine Pricing Trends

Post a comment

Report Abusive Comment