Ag Equipment Intelligence Newsbreak: The U.S. Senate swiftly passed the tax extender bill on Friday, Dec. 18.

This newscast kicks off with a status update on the tax extender bill impacting Section 179 expensing limits.

The bill was approved by the U.S. House of Representatives and now moves on to the Senate. In this newscast, we also take a look at dealers' outlook for 2016 commercial and consumer equipment, whether recent mergers like the Dow Chemical and DuPont deal give any credence to a Rabobank suggestion that OEM consolidation is likely, the potential for precision franchising, the current status of some ag fundamentals and the types of equipment most often stolen from farms.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment – including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business – matching the income stream of ag producers.

Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

Succession Planning in Farm Equipment Dealerships: Transitioning to the Next Generation

In this FREE special report, Farm Equipment examines the subject of succession planning from the rarely-covered vantage point of the successor generation.

I'm managing editor Kim Schmidt, welcome to our final episode of On the Record for the year.

House Votes to Make Section 179 Permanent

On Thursday afternoon, the U.S. House of Representatives approved a tax extender bill in a 318-109 vote. The bill makes Section 179 expensing limit of $500,000 permanent.

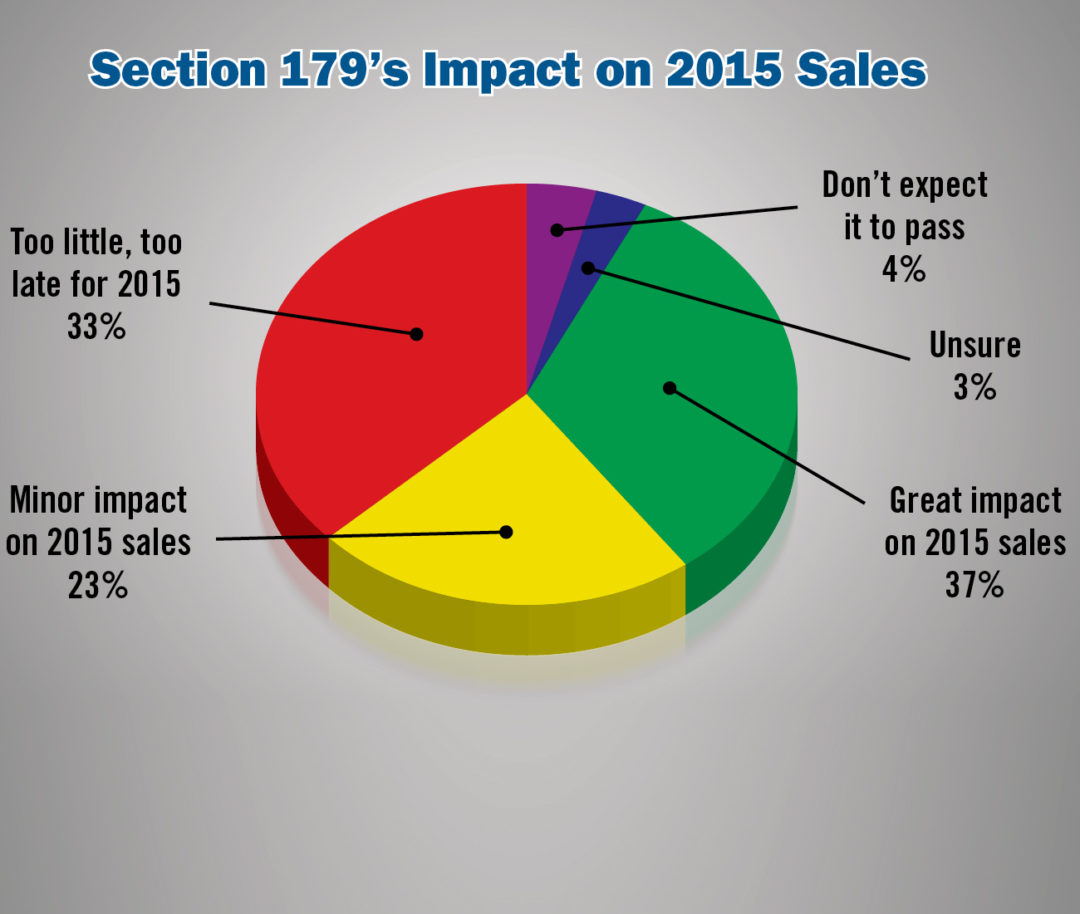

We polled dealers on Farm-Equipment.com asking them what sort of impact the passage of Section 179 legislation would have on their business. 37% said if passed it would have a great impact on their 2015 sales, while 33% said it’s too little too late. Another 23% said it would have a small impact on their 2015 sales.

|

FARM AFN: $33.15 +3.55 |

Another aspect of the bill should have a nice impact on dealers beyond equipment sales. The Farm Equipment Manufacturers Association said in a statement that equipment dealers should be pleased with a provision that allows retailers to depreciate remodeling and other improvements to their stores over 15 years rather than the previous standard of 39 years.

The White House has indicated support for the measure and it is likely President Obama will sign the bill once passed by the Senate. The Senate is expected to approve the bill, likely rolled in with the Omnibus spending package, by the end of the week, according to a report from The Hill.

Dealers Forecast Solid C&CE Sales in 2016

While large ag equipment sales continue to be sluggish, rural lifestyle dealers are optimistic in their sales forecast for 2016.

According to the Rural Lifestyle Dealer 2016 Dealer Business Trends & Outlook survey, more than 88% of North American dealers expect total revenues from this segment to be as good or better than last year.

Overall the economy is sending good signals in this market.

- New home construction and builder confidence is in the 60s (50 is neutral) as measured by the National Association of Home Builders/Wells Fargo Housing Market Index

- GIE registrations were up 11% in 2015 and exhibitors increased by 4%

- 46% of dealers expect revenues to increase by 2-7% compared to 39% in 2015

- 13% expect revenues to increase by 8% or more vs. 8% last year

- Only 11% expect declines of 2-8% or more vs. 16% last year

- Growing customer base - 68% of dealers say their markets have grown 5-20% over the last 5 years and 16% report growth of 20% or more.

The full report will be available in the Winter issue of Rural Lifestyle Dealer out next month.

Dow & DuPont Merge, Who’s Next?

On December 11, Dow Chemical and DuPont announced they were merging. The $130 billion deal combines two of the top suppliers of industrial and agricultural chemicals and crop seed.

According to the Wall Street Journal, each company has a market capitalization of about $60 billion, making them much larger than any of the major ag equipment makers.

However, agricultural products only make up a part of each company’s revenue.

This deal seems to lend some credence to Rabobank’s September 2015 report “Contraction Today, Consolidation Tomorrow? Looking Beyond the Downturn in North American Farm Equipment.”

Back in October, we took a look at the re port. In it, the authors Ken Zuckerberg and Harry Smit, suggest that consolidation among farm equipment OEMs is likely.

Another deal announced earlier this week fits with their hypothesis as well.

On December 14 Salford, a manufacturer of tillage, seeding and fertilizer application equipment announced it was acquiring AerWay advanced aeration products, manufactured by SAF-Holland Canada.

Geof Gray, CEO of the Salford Group, says the acquisition adds to the firms niche tillage product lineup and will allow them to offer more vertical tillage and pasture management tools that appeal to livestock and mixed farming customers.

Dealers on the Move

Minnesota Equipment is this week’s Dealer on the Move.

The dealer group was formed in 2008 by the merger of 5 John Deere dealerships in the greater Minneapolis area. Until now, the stores all operated under different names.

The stores included in the merger and name change are Isanti County Equipment, Sharber & Sons, Suburban Lawn Center and Weekend Freedom.

Exploring the Potential of Precision Franchising

The word consolidation is a term that farm equipment dealers are familiar with, perhaps having gone through the transitional process of acquiring a retailer or being acquired by one.

But this is a less familiar term for independent precision farming dealers who often build their businesses on the ability to integrate and troubleshoot technology on all brands of machinery.

Being colorblind in the precision industry has its advantages. However, the pending acquisition of Precision Planting by John Deere has precision dealers wondering what impact the deal — and potentially more like it in the future — will have on the sustainability and independence of their companies.

Deere has said publicly that it intends to leave Precision Planting’s distribution model intact. But the results of sister publication, Precision Farming Dealer’s recent poll revealed that 86% of respondents are “concerned” or “highly concerned” about the acquisition and what it could mean for independent dealers’ business going forward.

Talking with retailers since the Deere announcement, some interesting options have been discussed, including the possibility of consolidating with other independent dealers.

Taking this thought a step further, another dealer suggests that perhaps independent dealers with the most progressive and profitable business models may serve as parent companies of satellite offices.

This concept of franchising might not that be far fetched, allowing the most successful and profitable precision dealers to run several remote dealerships.

While this model could help elevate the profile and expand the reach of the top independent dealers, there is also the potential that overly rapid growth could dilute the quality of service and support loyal farm customers have come to expect.

It will be worth watching to see if further acquisitions and mergers in precision ag trigger consolidation among independent dealers, and how quantity will impact quality.

Ag Fundamentals Not as Bad as They Look

Ongoing sharp inventory correction is masking otherwise solid longer-term industry fundamentals, according to Avondale Partners analyst Igor Maryasis in a November 4 note announcing the firm’s coverage of Titan Machinery.

“While high horsepower equipment sales are down 45% from the industry peak in 2013, and approaching levels not seen since the early 2000’s, farm cash receipts, the main driver of equipment sales, are nearly double from where they were then,” says Maryasis.

He goes on to say that consumption of commodities is keeping up with global supply, and ending stocks are tight. “We believe we are in the overshooting stage and expect supply/demand to balance in 2016.”

Bottom Line: “Current equipment sales/production levels relative to farm cash receipts are unsustainable and we expect to see inflection in Fiscal Year 16,” he says.

Mowers & Lawn Tractors Most Stolen Equipment

Security InfoWatch, a website dedicated to the security industry, released a report this week on the growing security needs in agriculture.

Stolen property from farms ranges from cattle to equipment, and according to the report recovery rates are low for all classes of stolen property.

When it comes to stolen equipment, mowers and garden tractors make up 45% of the most commonly stolen pieces at 5,186, and tractors at 1,362 units stolen make up another 12%, according to the 2013 Equipment Theft Report.

The National Equipment Register and National Insurance Crime Bureau released the report on equipment theft in the U.S. based on data from the National Crime Information Center’s database.

According to the report, the top brands of stolen equipment are John Deere, Kubota Bobcat and Caterpillar.

Toro, Case, Husqvarna, Craftsman, Exmark and Cub Cadet round out the top 10.

Implement & Tractor Archives

In 1981, John Deere introduced the 450 Hydra-Push spreader, which eliminated the apron chain, reduced manual cleanout in cold weather and provided faster, more uniform unloading.

The spreader was developed by John Deere customers Joseph and Daniel O’Reilly, dairy farmers from Goodhue, Minn.

The farmers were frustrated by how quickly the apron chains rusted in manure and by how difficult it was to use and maintain the spreader in winter.

So they came up with the idea to push the manure to the rear with a movable front endgate, like that used in garbage trucks, and coat the floor and sides of the spreader in plastic to make it more dependable in a variety of conditions.

And as always, we welcome your feedback. You can send comments or story ideas to kschmidt@lessitermedia.com.

On behalf of the entire Farm Equipment and Ag Equipment Intelligence team, may you have a merry Christmas and a prosperous new year. Thanks for watching, I’ll see you in 2016!

Post a comment

Report Abusive Comment