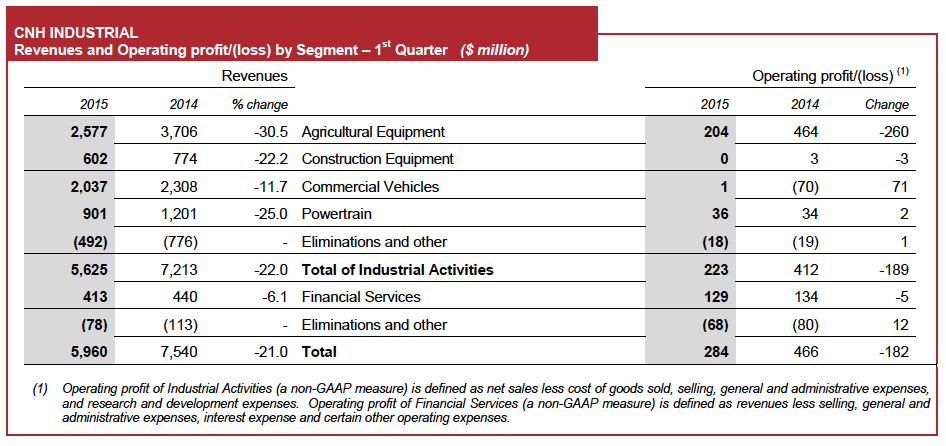

LONDON (UK) – CNH Industrial N.V. today announced consolidated revenues of $5,960 million for the first quarter 2015, a decrease of 11.1% compared to Q1 2014 on a constant currency basis (down 21.0% on a reported basis). Net sales of Industrial Activities were $5,625 million in Q1 2015, down 11.9% compared to Q1 2014 on a constant currency basis (down 22.0% on a reported basis). Net of the negative impact of currency translation, net sales increased for Commercial Vehicles (+5.6%), mainly driven by positive volume and mix in EMEA offsetting challenging trading conditions in LATAM. This increase was more than offset by the forecasted decline in Agricultural Equipment, due to unfavorable industry volume and mix in all regions primarily in the row crop sector of the business, in Construction Equipment, due to negative volume and mix primarily in LATAM, and in Powertrain, due to lower sales to captive customers.

Operating profit of Industrial Activities was $223 million in Q1 2015, a 39.4% decrease compared to Q1 2014 on a constant currency basis (down 45.9% on a reported basis), with an operating margin at 4.0% (5.7% for Q1 2014). Operating profit declined in Agricultural Equipment, driven by negative volume and mix including negative industrial absorption as a result of forecasted inventory balancing measures, partially offset by positive net price realization, purchasing efficiencies and positive contribution from structural cost reductions.

Commercial Vehicles’ operating result improved due to favorable volume and mix and cost reductions in selling, general and administrative (“SG&A”) expenses. Powertrain operating profit improved mainly due to positive product mix, industrial efficiencies and SG&A expense reduction. Construction Equipment reported breakeven operating profit, substantially flat compared to Q1 2014, as unfavorable volume and mix, mainly in heavy equipment in LATAM, were offset by structural cost containment actions implemented last year.

Agricultural Equipment

Agricultural Equipment registered net sales of $2,577 million for the quarter, down 23.9% compared to Q1 2014 on a constant currency basis (down 30.5% on a reported basis), as a result of unfavorable industry volume and mix in all regions primarily in the row crop sector. The geographic distribution of net sales for the period was 45% NAFTA, 32% EMEA, 12% LATAM and 11% APAC.

Worldwide agricultural equipment industry unit sales were down 14% for tractors and down 26% for combines. In our key product segments within NAFTA, the over 140 hp tractor segment was down 26%, and combine demand was down 44%. Smaller hp tractors in NAFTA were slightly positive, with the under 40 hp segment up 2%, and the 40-140 hp segment up 4%. In LATAM, tractor and combine markets decreased 10% and 35%, respectively. EMEA markets were down 14% for tractors and 8% for combines. APAC markets decreased 17% for tractors and 19% for combines. Agricultural Equipment’s worldwide market share performance was up for both tractors and combines. For tractors, our market share was down in LATAM as a result of destocking, and up or flat in all other regions. For combines, our market share was down in APAC, but increased in all other regions.

In Q1 2015, Agricultural Equipment’s worldwide unit production was 4% above retail sales in support of the expected seasonal increase in demand from dairy and livestock customers. In row crop related products comparable production units were cut significantly with production for worldwide combine and high horsepower tractors in NAFTA down 40% versus last year as part of the Company’s efforts to balance inventory with forecasted demand.

Agricultural Equipment’s operating profit was $204 million for the quarter ($464 million in Q1 2014). Operating margin decreased 4.6 p.p. to 7.9% (12.5% in Q1 2014), driven by negative volume and mix including negative industrial absorption, with production hours declining nearly 40% in NAFTA and LATAM, partially offset by net positive price realization, purchasing efficiencies and a positive contribution from structural cost reductions.

Post a comment

Report Abusive Comment