If you’re a betting person, the best bet you could make (at the moment) is that the strongest segment for ag equipment sales in the year ahead will be centered on livestock producers, cattle in particular.

As far as the major grains go, no significant rebound is anticipated in 2015 as supplies continue to outstrip demand worldwide. In its Jan. 12 World Agricultural Supply and Demand Estimates (WASDE) report, USDA projected 2014-15 marketing year pricing for corn to range between $3.35-$3.95 per bushel. That’s down from the calendar year average price received in 2012 of $6.67, which was the highest over the past decade. USDA’s latest outlook for soybean price in 2014-15 ranged between $9.45-$10.95 per bushel, down from the 2013 high of $14.07. The price of wheat is projected to range from $5.90-$6.30 per bushel in the year ahead vs. the decade’s highest price of $7.60 in 2012.

Strong Cattle Prices

All signals point to continued strong cattle pricing going into 2015. This trend should bode well for the sale of mid-range tractors (40-100 horsepower), which have experienced solid growth during the past 2 years, and it may even give a lift to high horsepower equipment. Unit sales of mid-range tractors were up year-over-year by 12.1% in January.

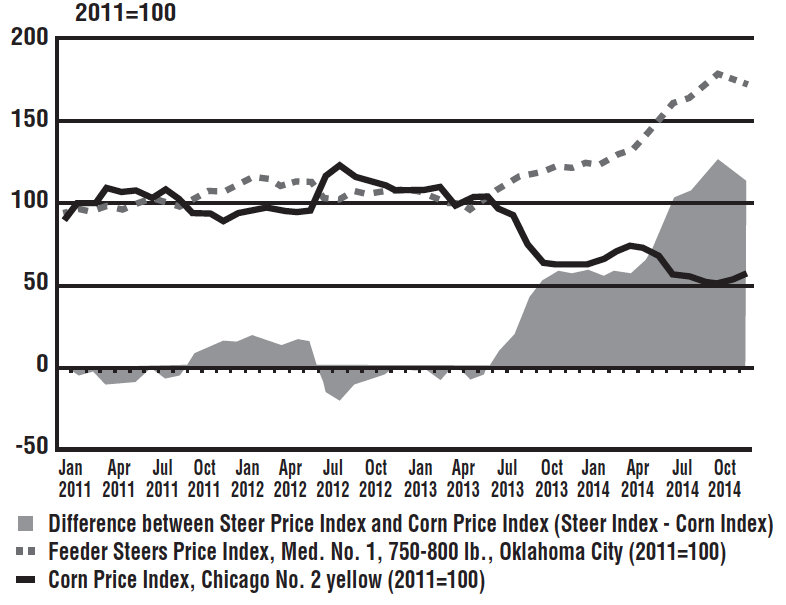

Strong feeder cattle prices and declining feed costs are supporting high returns for cow-calf producers. The price of 750-800 pound feeder steers at the Oklahoma National Stockyards exceeded $220 per hundredweight at the end of 2014, up $65 since January and over $100 since May 2013. At the same time, the price of corn (a major component of cattle feed) fell from above $7 per bushel in mid-2013 to under $4 per bushel by December 2014, reflecting a record 2014 crop projected at 14.4 billion bushels.

Despite weaker demand, beef prices are at record high levels due to tight supplies and historically low cattle inventories. Expanding the cattle herd is a long-term process due to the time it takes cattle to mature. It also requires holding some heifers off market for breeding purposes. Recently released data from USDA’s Cattle report suggests that inventories are beginning to grow and cattle prices have begun to retreat. With corn prices forecast by USDA to average around $3.50 per bushel for the 2014-15 marketing year, returns to cow-calf operators should remain favorable into 2015.

The price received per hundredweight of cattle hit a new record in 2014 of $154.33. This compares to the $95.18 received 10 years earlier, which is a gain of 62%. The lowest price received for U.S. cattle in the last decade occurred in 2009 when the price per hundredweight came in at $85.36. In the December WASDE, USDA suggested the average price of fed steers will be between $160-$172 per hundredweight.

The price of U.S. hogs per hundredweight has seen a nice run up in recent years, as well. Compared to the price received in 2005 ($50.03), hogs, $77.10 last year, were up by 54%. The lowest price for hogs occurred in 2009 when it fell to $42.27 per hundredweight. The 2014 price represented an 82% increase over that low. Hog prices are expected to average $60-$65 per cwt this year, according to USDA.

Dairy farmers saw a decade high price for milk of $23.98 per hundredweight last year. Compared to 10 years earlier ($15.15), that was a jump of 58%. The lowest price received for milk took place in 2009, when it dropped down to $12.81. Compared to the low, milk per hundredweight in 2014 was up by 87%. USDA’S all-milk price forecast for 2015 fell into the range of $17.40-$18.10 per cwt.

|

Feeder Steer Index vs. Corn Price Index 2011-14

Note: Data through December 2014. Source: USDA Economic Research Service |

Post a comment

Report Abusive Comment