Advertise Follow Us

A Deep, Data-Driven Analysis of Brand Loyalty in Agriculture

Traditionally, farmers are known to be dogged loyal to and identify closely with certain “colors” when it comes to the brand of equipment they purchase. To emphasize the competitive nature of the farm machinery business, not too awfully long ago, it was common to see signs in dealerships that read, “Friends don’t let friends drive red tractors” or “green tractors,” whatever the case may be. It wasn’t at all unusual to hear farmers brag about the superiority of their preferred brand of machinery.

Some in the ag equipment business insist that this level of brand loyalty has diminished over the years, and in today’s world of tight farming margins they would argue that price has now unseated brand as the biggest purchasing factor. But you may be surprised what the farmers are actually telling us.

Every three years since 2011, Ag Equipment Intelligence editors have extensively surveyed farmers across 12 states encompassing the Corn Belt (Illinois, Indiana, Iowa, Ohio, Missouri), Lake States (Michigan, Minnesota, Wisconsin) and Northern Plains (Kansas, Nebraska, North Dakota, South Dakota) regions of the U.S. to gauge the level of loyalty they hold toward equipment.

The culmination of a nearly a decade-long study, Ag Equipment Intelligence has now combined this extensive primary research into an insightful, comprehensive and unique dealership management report, Brand Loyalty in the Farm Equipment Business.

Order Your Copy Now For Only $99.95 and get FREE shipping

Brand Loyalty in the Farm Equipment Business offers an essential business strategy tool to help you better understand and position your dealership’s unique selling proposition, products and overall value against your competition amidst an ever-shifting ag equipment landscape. It offers a tool to help you be better informed and prepared to align your dealership and the brands you represent with the right customers, at the right time and with the right message.

Pick up your copy today and discover answers to these critical brand loyalty questions and more…

What would it take for farmers to switch to another equipment brand? Many dealers believe that price is the most important aspect for farmers when it comes to purchasing equipment, but would you be surprised to learn that it isn’t even in the top three? Do you know how big of a role a dealerships people, location and facility play in maintaining customer loyalty? You’ll learn the most common reasons farmers switch brands, so you'll see which aspects of your business may be driving customers away and the areas of opportunity to gain and retain new customers.

How does a farmers' revenue affect their purchasing practices? When comparing farmers who annually make over $1 million to farmers who make less than $1 million, you most likely aren’t surprised to hear there are differences in how and why they purchase equipment. But did you know there are more similarities between the two, especially when it comes to switching brands? Learn where revenue levels matter most, so you can better understand how to effectively market your equipment to your every type of customers – from the low-acreage hobbyist to the high-acreage producer.

Where do farmers and dealers differ on brand loyalty? Not only does this report offer key insight into the purchasing psyche of the grower, but you'll also get insight into the dealers' perceptions of brand loyalty. You'll learn about what areas dealers and farmers disagree on more often than not on the level of customer loyalty to a specific manufacturer. You'll also learn the top dealers' impressions of farmers’ purchasing practices and how they compare to farmers’ responses.

How do individual manufacturers score with farmers who prefer particular brands? Do you know why farmers prefer specific brands? Would it surprise you to learn that the factors causing farmers to switch brands differ widely depending on what brand the farmer prefers? This report segments responses and trends by brand to show how the individual brands compare. You’ll hear direct commentary from brand-specific farmers so you can better cater to their needs within your dealership and the brands you represent.

For a deep, data-driven dive into brand loyalty in agriculture today, purchase your copy of Brand Loyalty in the Farm Equipment Business now for just $99.95 and get FREE shipping.

SPECIAL BONUS OFFER

Take advantage of this one-time bonus offer! Purchase a subscription to Ag Equipment Intelligence for only $449 (a $50.00 savings) and...

GET THE 'BRAND LOYALTY IN THE FARM EQUIPMENT BUSINESS' REPORT FREE!

Subscribe Now To The Ag Equipment Marketer's #1 Resource!

Tired of being taken by surprise? Using outdated data? Working with incomplete or inaccurate facts? Being the last one to know?

Then welcome Ag Equipment Intelligence. The newsletter that the most successful ag equipment dealers read. The people you compete with. The newsletter that will level the playing field for you. Keep you updated on all the important news in the ag equipment industry. In-depth reports, trends, analysis and opportunities.

When you subscribe to Ag Equipment Intelligence, you'll get all the tools and information you need to successfully grow your dealership.

Your Subscription Includes:

Ag Equipment Intelligence Newsletter (12 annual issues) (A $699 Value!)

Measuring and monitoring the major farm equipment trends. News and analysis of industry macro trends using a wide range of sources: -Earnings reports and other financial news that signal general economic health of individual players, including dealers, fullline and shortline manufacturers, as well as the industry as a whole.

• Dealer Consolidation – acquisitions and mergers – and other significant moves that impact the industry’s distribution channels.

• Movement in various industry segments (e.g. crops, dairy, livestock, rural lifestyle) such as commodity pricing and cropping segments that could affect ag machinery sales over the long term.

• Evaluation of land prices, farmers’ balance sheets and other industry developments that indicate the general direction of the farm economy.

• International news of equipment sales trends and significant moves by overseas manufactures that have ramifications for the North American ag machinery market.

• Larger, longer-term trends (e.g. ag cycles) that suggest changes in industry fortunes.

Subscribe Today – Our Best Deal

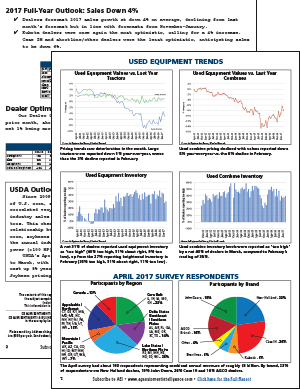

Dealer Sentiments & Business Conditions Update (12 annual issues) (A $699 Value!)

Offers monitoring and reporting of ongoing farm equipment industry trends in North America that often go unnoticed, including a measure of dealer optimism.

Reports the “raw numbers” from monthly surveys of North American dealers that represent their current views toward short and mid-term industry sales and other micro-trends that can result in longer-term impacts, including:

Month Sales Growth vs. Previous Month and Previous 2 Years

Overall & by major brand • By 10 U.S. regions & Canada • By 12 equipment categories • Dealer results vs. expectations

Current Trends

Price contribution to sales • Manufacturer incentives • Factory lead times

Equipment Inventories

New equipment backlog • Used equipment backlog

Dealer Commentary

Monthly Sales • Used equipment Inventory

Subscribe Today – Our Best Deal

Executive Summary – Dealer Sentiments & Business Conditions Update (12 annual issues)

A 4-page executive summary delivered directly to your email inbox, providing you with a concise analysis and main conclusions of the full monthly report, saving you time while still giving you the valuable information you need to make better business decisions.

Subscribe Today – Our Best Deal

Ag Equipment Intelligence Dealer Business Outlook & Trends Report (A $299 Value!)

A 48-page special dealer report published each October and sent only to AEI subscribers, providing you with the most comprehensive and in-depth analysis, trends and forecasts available for the ag equipment industry today.

Features Ag Equipment Intelligence’s primary research of trends at the dealer level. Breaks out dealerships by country, by region, by equipment brand and size of dealership. Also includes North American farm equipment industry retail sales & inventory data, used farm equipment pricing and inventory analysis and other focused topics that impact ag equipment sales.

Subscribe Today – Our Best Deal

Big Dealer Report (An $89 Value!)

An annual update of North American dealer consolidation trends. Since 2009 Ag Equipment Intelligence and Currie Management Consultants have tracked and compiled the dynamic changes taking place with farm equipment dealer ownership in the U.S. and Canada.

Along with a review of major dealers events during the prior year, the updated report also provides a complete list of North America’s “Big Dealers” by location, brand and shortlines carried, along with commentary on emerging distribution trends in the industry.

Subscribe Today – Our Best Deal

Special Reports (A $199 Value)

Each year the editors at Ag Equipment Intelligence produce special reports covering important topics of the farm equipment industry. Previous special reports include “Benchmarketing No-Till Farming in the U.S.,” “Ag Equipment In South America,” Biofuels: Possibilities and Potential for Ag Equipment” and studies of the “Agricultural Equipment Industry in China” and “Russia, Ukraine and Kazakhstan: The State of Farm Technology in the Common wealth of Independent States.”

Subscribe Today – Our Best Deal

Ag Equipment Capital Markets Report (A $99 Value!)

For private business owners, the valuation multiples of comparable publicly traded companies can provide you with a relevant valuation metric. This report provides highly relevant, proprietary data on M&A transactions in the ag equipment marketplace. Other topics covered in this report are: M&A trends and key transactions, Agricultural equipment public markets performance, M&A transactions and historical trends, Public company analysis, and more...

The report’s author, Eric Bosveld, leads SDR Ventures’ M&A advisory practice for businesses participating in and serving the agricultural marketplaces in the U.S. and Canada.

Subscribe Today – Our Best Deal

Online Archives

Need to check industry sales or trends but don’t have your issue with you? No problem. All Ag Equipment Intelligence issues and special reports are available for online viewing and are available only to Ag Equipment Intelligence subscribers in good standing. Online all the time, get the information when you need it.